What’s New in CoinGlass API V4 (Crypto API)

Source: Dev.to

CoinGlass API V4 represents a major evolution of the CoinGlass data platform. It introduces a more structured, scalable, and analytics‑oriented API architecture designed to support advanced crypto market analysis, production‑grade trading systems, and institutional data infrastructure.

API V4 is the current and recommended version of the CoinGlass API. Earlier versions (V1–V3) are maintained for backward compatibility but are no longer the primary focus for new development.

CoinGlass API V4 – Official Documentation

1. Unified Multi‑Market Data Architecture

CoinGlass API V4 provides a unified access layer across derivatives, options, spot, ETF, and on‑chain markets, enabling consistent data consumption across different market types.

Compared to earlier versions, V4 standardizes market abstractions and data schemas, allowing users to work seamlessly across instruments without maintaining separate integration logic for each market.

Key Improvements

- Consistent data models across market types

- Unified symbol and asset representations

- Improved cross‑market comparability

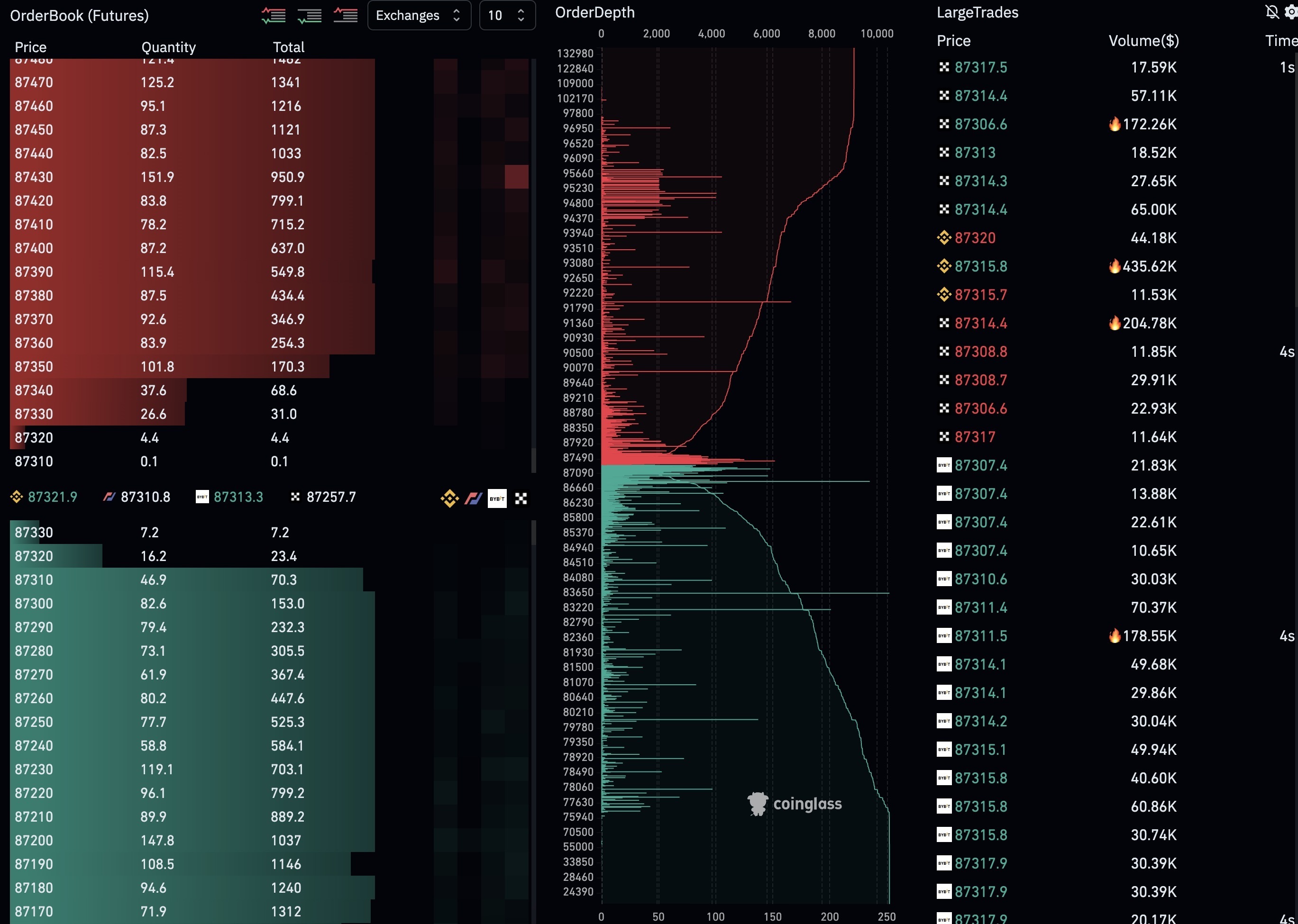

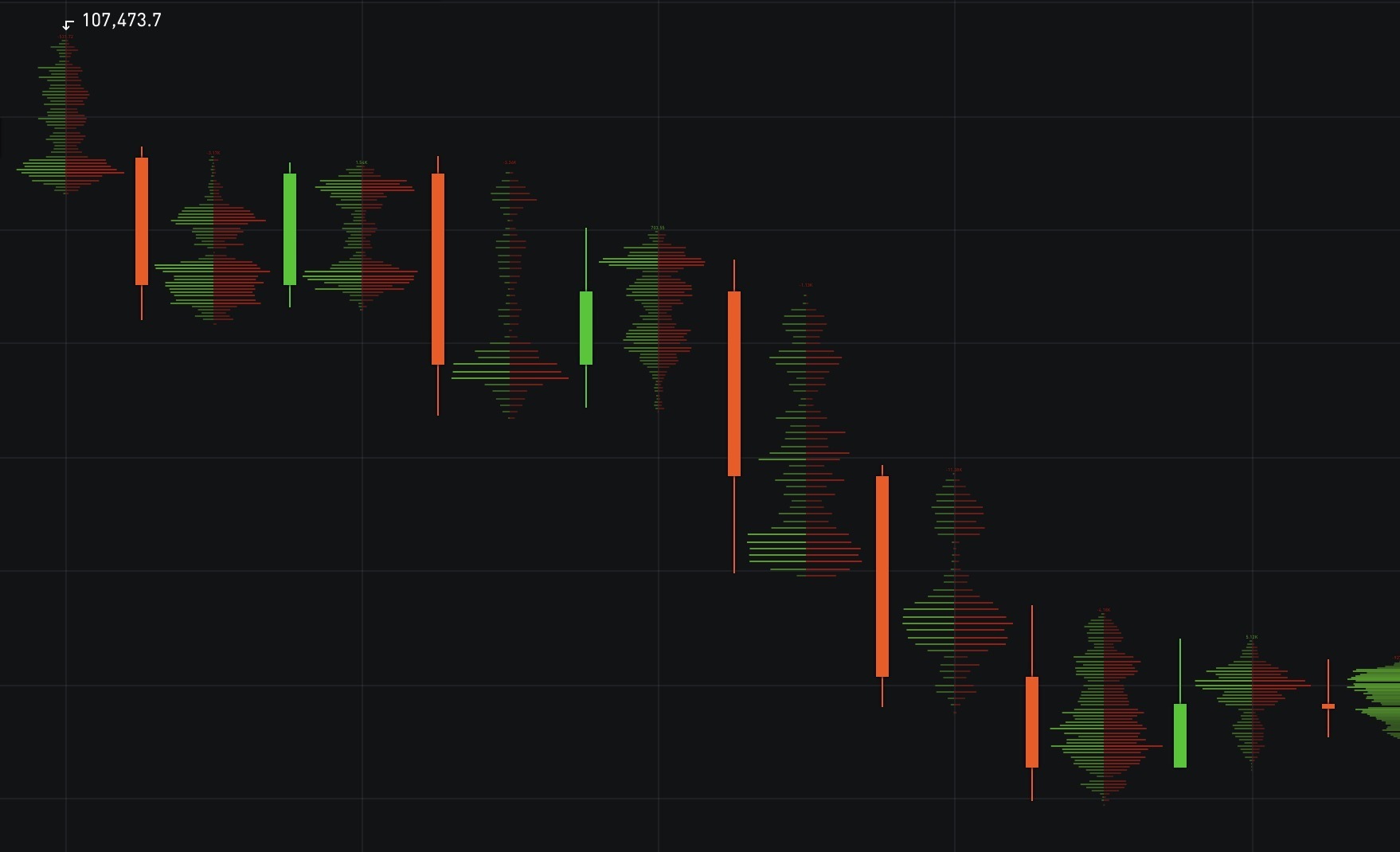

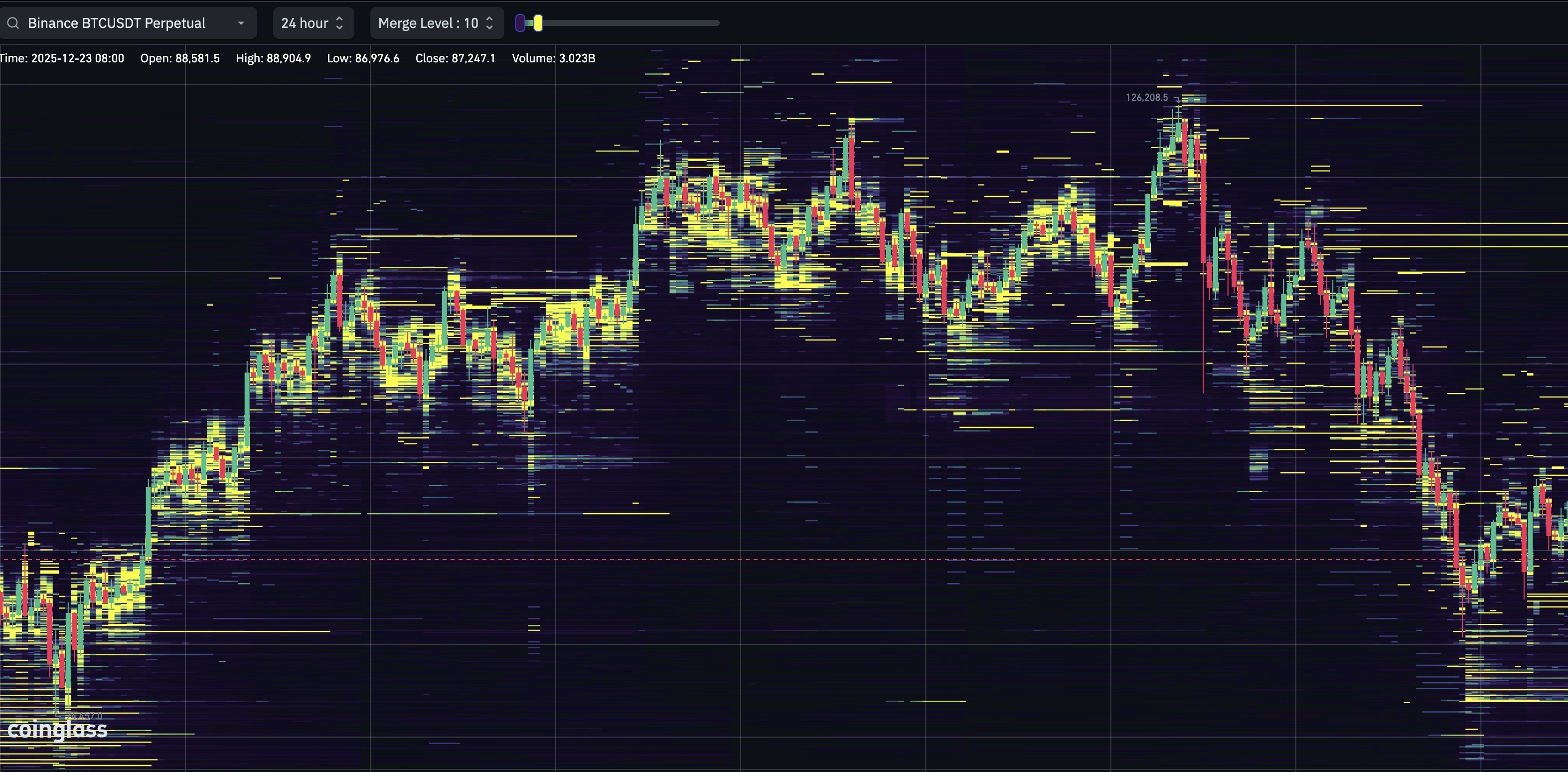

2. Expanded Market Structure & Order‑Flow Data

API V4 significantly enhances CoinGlass’s market‑structure coverage, introducing deeper visibility into order‑book dynamics and trading behavior. The new version supports order‑flow data combined with L2 and L3 order‑book depth, enabling detailed analysis of liquidity distribution, large‑order behavior, and micro‑structure‑driven strategies.

New and Enhanced Data Capabilities

| Capability | Documentation |

|---|---|

| L2 & L3 order‑book depth | Orderbook Bid & Ask Documentation |

| Order‑flow & execution‑level data (Footprint) | Footprint Documentation (link to be added) |

| Liquidity distribution & large‑order tracking (Orderbook Heatmap) | Orderbook Heatmap Documentation |

Sample Visualisations

| Description | Image |

|---|---|

| L2/L3 Order‑book Depth |  |

| Order‑flow Footprint |  |

| Orderbook Heatmap |  |

These capabilities make API V4 suitable for advanced quantitative research, high‑frequency analysis, and institutional‑grade monitoring systems.

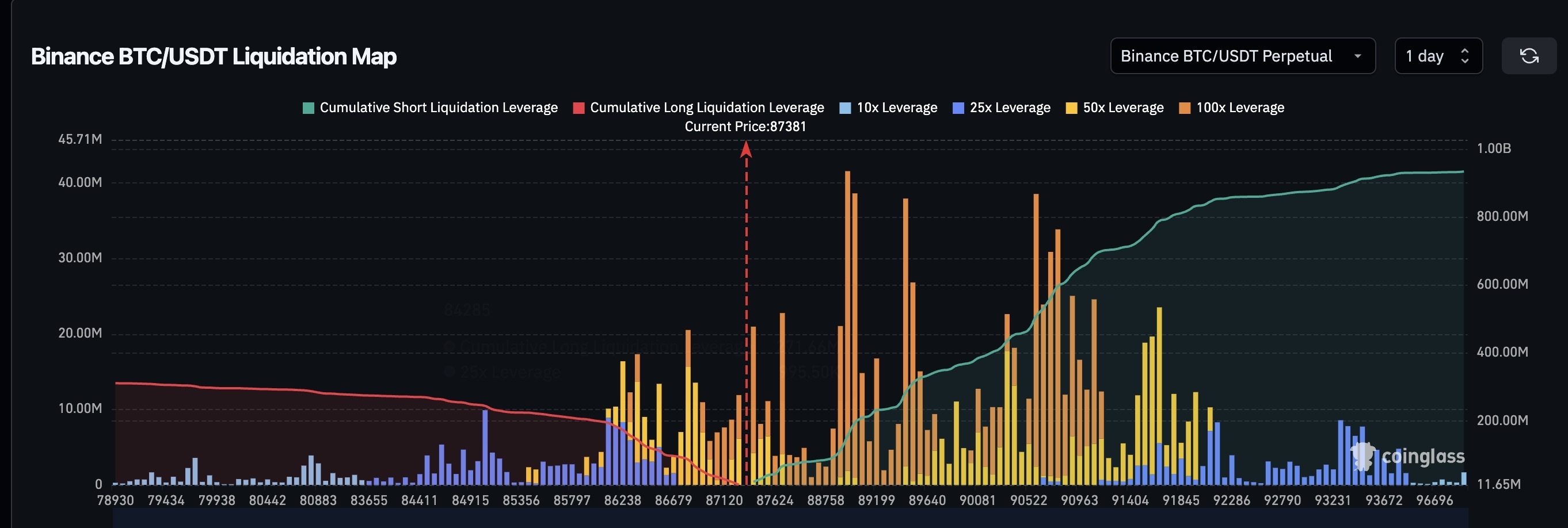

3. Advanced Liquidation & Risk Analytics

Building on CoinGlass’s core strength in derivatives markets, API V4 delivers expanded and more structured liquidation‑related datasets. In addition to raw liquidation events, V4 provides higher‑level analytical representations that help identify risk concentrations and market‑stress zones.

Enhanced Liquidation Analytics

| Feature | Documentation |

|---|---|

| Liquidation events | Liquidation Order Documentation |

| Liquidation heatmaps | Liquidation Heatmap Documentation |

| Liquidation maps & levels | Liquidation Map Documentation |

Sample Visualisations

| Description | Image |

|---|---|

| Liquidation Events |  |

| Liquidation Heatmap |  |

| Liquidation Map |  |

| Additional Liquidation Visual |  |

These datasets are designed to support proactive risk management, volatility analysis, and derivatives‑market monitoring.

4. Broader Institutional & Macro Data Coverage

API V4 extends beyond pure trading data by integrating institutional and macro‑level indicators that are increasingly relevant to professional market participants.

New and Expanded Datasets

- ETF net flows and holdings – ETF Net Flows Documentation

- On‑chain reserves and ERC‑20 transfers – ERC‑20 Transfers Documentation

- Whale and large‑position activity – Whale Transfer Documentation

- Macro indicators (Crypto Fear & Greed, Stock‑to‑Flow, Rainbow Charts) – CoinGlass API V4 – Official Documentation

5. Improved Consistency, Scalability & Developer Experience

CoinGlass API V4 is designed for long‑term, production‑grade usage. The API introduces improved consistency across endpoints and response formats, reducing integration complexity and maintenance overhead.

Developer‑focused Improvements

- Standardized response schemas across endpoints

- Enhanced pagination, filtering, and query patterns

- Clearer versioning and forward‑compatible design

These changes make API V4 easier to integrate, scale, and maintain within complex data pipelines and real‑time systems.

6. Designed for Professional & Institutional Use Cases

API V4 supports a wide range of professional scenarios, including:

- Quantitative trading and strategy development

- Market research and historical analysis

- Risk monitoring and liquidation surveillance

- Data platforms and analytics dashboards

- Institutional reporting and decision support

By combining deep data coverage, advanced analytics, and scalable infrastructure, CoinGlass API V4 serves as a foundation for modern crypto market‑intelligence systems.

Migration & Versioning Notes

- Current production version: API V4

- Earlier versions (V1–V3): Still available for compatibility but may not receive new features.

Recommendation: New users should start with API V4 for the most complete and future‑proof experience.

For migration guidance or technical questions, refer to the API documentation or contact the CoinGlass support team.

- CoinGlass API V4 – Official Documentation

- To view the original article, click here.