From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

Source: Dev.to

Opening: Let’s Talk About the Hassles of Validating Trading Ideas

Hey, I wonder if anyone else has had this experience: you’re watching the market at night and suddenly come up with a trading idea—like noticing certain common characteristics before some coins pump. Then you want to verify whether this idea actually works, but you find out you need to write code, deal with data, and all that stuff. It’s such a hassle. By the time you actually get around to doing it, either you’ve forgotten what you were thinking, or the market conditions have already changed.

How Torturous the Traditional Validation Process Is

To be honest, validating an idea used to be really exhausting.

- Get the data – find various API interfaces, register accounts, apply for API keys, and then write code to scrape the data. This step alone can keep you busy for ages.

- Translate the fuzzy idea into concrete formulas – write those formulas into code.

- Back‑test – consider all sorts of messy things like transaction fees and slippage.

The whole process takes half a day if you’re lucky, but could take several days if you’re not.

Trading Ideas Have an Expiration Date Too

Good trading ideas actually have a shelf life. Especially in crypto, things change incredibly fast. A pattern you discover today might stop working in a week or two. Traditional validation methods are too slow to keep up.

Plus, inspiration doesn’t come at convenient times—it often strikes when you’re on the subway or taking a shower. You can’t exactly start coding right then and there, can you?

The Simple Validation Method I Want

So I started thinking: couldn’t we make validating ideas simpler? I just need to describe my idea in words and let the tools handle the rest—no coding, no data wrangling. When the results come out, they directly tell me whether it works or not.

In short: I do the thinking, the machine does the validation.

Implementing It with FMZ Workflow

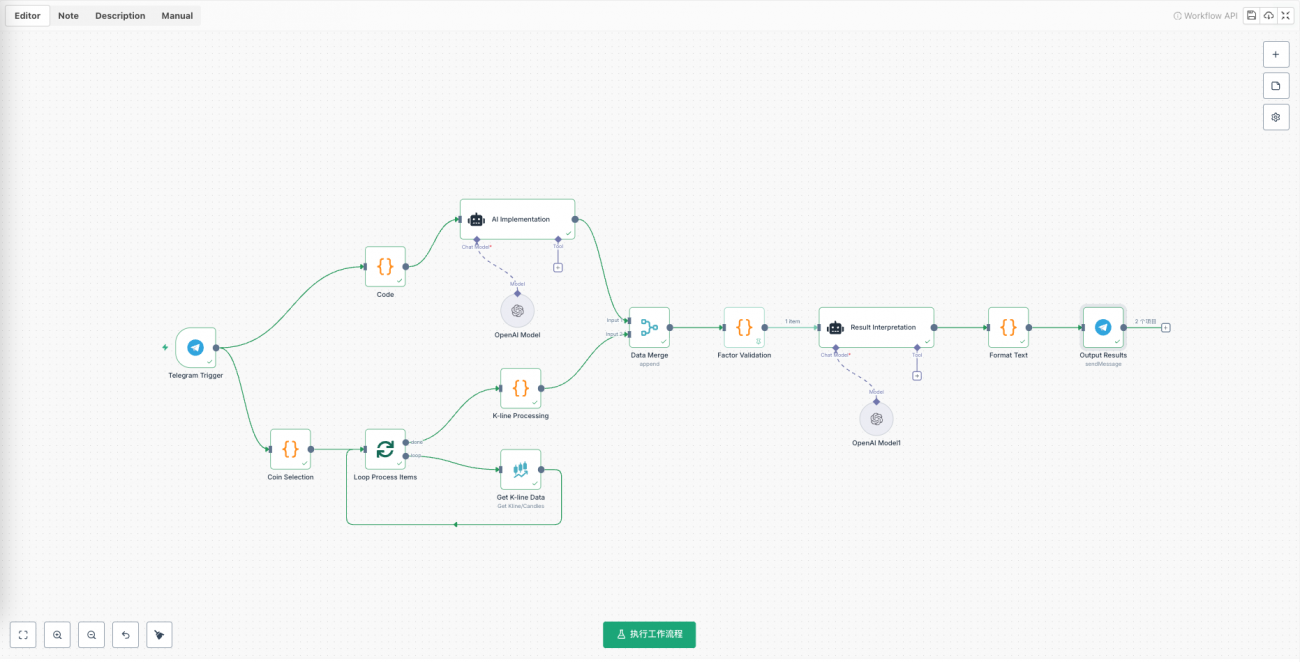

Later, I built an automated workflow using FMZ (Inventor Quantitative). FMZ’s workflow is specifically customized for quantitative trading and can chain various tools together.

The entire process works like this:

- When inspiration strikes, open your phone and input your factor description.

- An AI converts the description into executable code.

- FMZ automatically retrieves cryptocurrency data.

- The AI performs factor‑validation calculations.

- The AI translates the results into plain language and sends them to you.

The whole process is completely automated—you just wait for the results.

Factor Validation Flowchart

flowchart TD

A[📱 Input Idea via Telegram] --> B[🧠 AI Understands Factor Description]

B --> C[💻 Generate JavaScript Code]

C --> D[📊 Retrieve Cryptocurrency Data]

D --> E{🔍 Data Check}

E -->|Sufficient Data| F[⚙️ Factor Calculation]

E -->|Insufficient Data| Z[❌ Return Error]

F --> G[📈 IC Analysis]

F --> H[📉 Monotonicity Analysis]

F --> I[⏱️ Decay Analysis]

F --> J[💰 Cost Analysis]

G --> K[🤖 AI Interprets Results]

H --> K

I --> K

J --> K

K --> L[📋 Generate Evaluation Report]

L --> M[📲 Push Results via Telegram]The Setup Process Isn’t Actually That Complex

Setting up this workflow mainly requires a few steps:

- Configure the AI model’s API – I used OpenRouter’s interface, which can call large models like DeepSeek.

- Configure FMZ’s data interface – retrieve K‑line data.

- Write the factor‑validation logic – includes statistical tests and monotonicity analysis. (Don’t worry if you don’t understand the professional analysis results; the AI will explain them.)

- Configure a message push – send the results to Telegram.

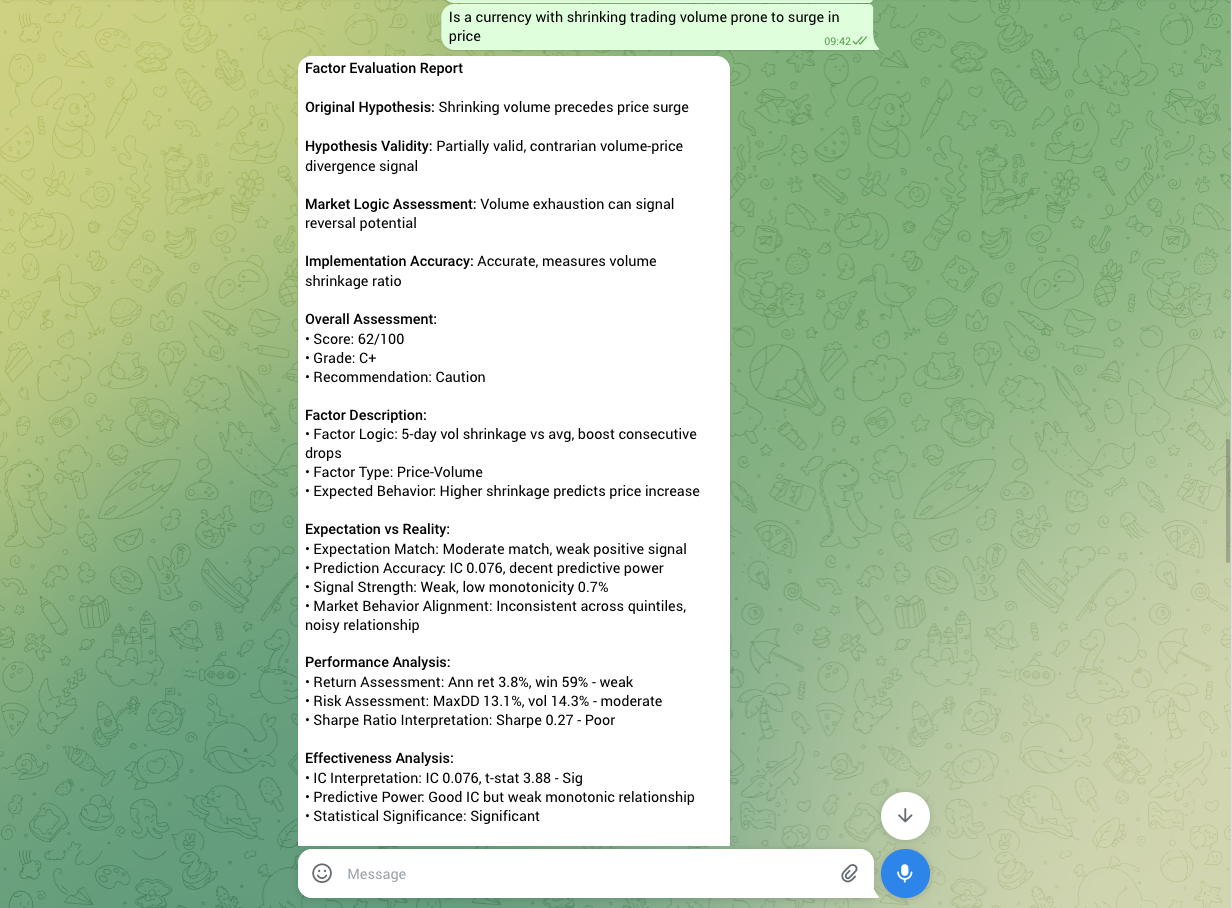

What the Validation Results Can Tell You

When you open the analysis report, you’ll see a lot of information:

- Overall score and rating – a quick glance at reliability.

- Factor construction code – AI‑generated, well‑structured, and heavily commented. Even if you can’t code, reviewing enough of these snippets will teach you the logic of factor construction.

- Interpretations of performance metrics – the AI explains IC, Sharpe ratio, turnover rate, etc., in plain language, so you understand the meaning behind each indicator.

In short, the report not only tells you whether a factor has potential, but also serves as an AI tutor that helps you learn quantitative‑trading concepts step by step.

Improvement Suggestions – Why This Section Matters

The AI doesn’t just say “it doesn’t work.” It gives specific optimization directions based on the validation results—e.g., change the time‑period, reverse the factor, add complementary signals. All suggestions are derived from data analysis, not random guesses.

Takeaway: Even when a factor fails, you learn how to write the code, why it failed, and how to improve it. Over time your quantitative‑trading knowledge deepens.

Real‑World Example: “Small Amplitude Yesterday, Large Gains Today”

📊 Factor Evaluation Results

| Category | Result |

|---|---|

| Overall Score | 42 / 100 |

| Rating | C+ |

| Recommendation | Not recommended for use |

🔍 Original Hypothesis Validation

| Aspect | Comment |

|---|---|

| Hypothesis | “Small amplitude yesterday predicts a high probability of upward movement today.” |

| Theoretical Validity | Somewhat reasonable – low volatility may precede trend breakouts or mean‑reversion. |

| Market Logic | Crypto markets show volatility clustering, but a single‑day amplitude signal is weak. |

| Code Accuracy | Implementation correctly calculates yesterday’s amplitude and returns its negative value. |

📈 Performance Analysis Details

💰 Return Performance

- Annualized Return: ‑18.66 % (expected positive, got negative)

- Win Rate: 56.4 % (slightly above random)

- Cumulative Return: ‑24.57 % (opposite of expectation)

⚠️ Risk Indicators

- Maximum Drawdown: 30.08 % (poor risk control)

- Volatility: 18.42 % (high)

- Sharpe Ratio: ‑1.01 (severe loss after risk adjustment)

🔬 Statistical Test Results

| Test | Metric | Value |

|---|---|---|

| Predictive Ability (IC) | IC Mean | 0.063 |

| t‑statistic | 2.93 (significant) | |

| Rank IC | 0.053 | |

| Information Ratio (IR) | 0.158 | |

| Monotonicity | Monotonicity Score | 0.083 (extremely weak) |

| Monotonicity Rate | 3.49 % | |

| Long‑Short Spread | Spread | ‑0.0008 (long & short equally effective) |

⏱️ Factor Stability

- Half‑life: 1 day (signal decays extremely fast)

- Autocorrelation: ‑0.093 (negative, unstable)

- Recommended Rebalancing Frequency: Daily (requires high‑frequency rebalancing)

💎 Market‑Cap Consistency

| Cap | IC |

|---|---|

| Large | 0.040 |

| Mid | 0.037 |

| Small | 0.037 |

| Consistency | Good (similar performance across caps) |

💸 Trading‑Cost Analysis

- Average Daily Turnover: 41.95 % (high‑frequency trading)

- Cost Erosion: 10.26 % of annualized return

- Net Return: ‑28.92 % (worse after costs)

🎯 Factor Code Implementation

// Yesterday's Amplitude Factor Calculation

if (closes.lengthResult: You don’t need to be a programmer; you only need to express the idea clearly.

Even when the AI rejects an idea, the feedback is a valuable step on the road to success.

Illustrative Images

What Happens When Validation Becomes Faster

When validation becomes very fast, your entire research habits change. Previously you could validate at most two or three ideas per month; now you can validate over ten ideas in a single day.

Because you’re no longer afraid of failure and the validation cost is low, you dare to try all kinds of unusual ideas. Through large quantities of rapid validation, your understanding of the market deepens progressively. This is what they mean by quantitative change leading to qualitative change.

It’s Not a Silver Bullet

- AI’s comprehension ability is limited—ideas that are too complex might be misunderstood.

- Data coverage also has limits; it can only validate phenomena present in historical data.

- Historical effectiveness doesn’t guarantee future effectiveness—everyone understands this principle.

This tool mainly helps you quickly screen ideas, eliminate obviously unreliable ones, and identify directions worth deeper research.

This Is Just the Beginning

The single‑factor validation shared here is only the starting point for multi‑factor models. In actual trading, the effectiveness of individual factors is often limited—what’s truly useful is a combination of factors.

Example: Combining momentum, volume, and volatility factors produces more stable results.

If there is interest, I’ll continue with videos on:

- Multi‑factor validation

- Factor synthesis

- Building live trading systems

Conclusion

The greatest significance of this tool is that every idea gets a chance to be validated. Previously, many ideas were overlooked because validation was too troublesome. Now the barrier is lower, so you can confidently and boldly test all kinds of ideas.

In this rapidly changing market, the most fearsome thing isn’t making mistakes—it’s missing opportunities. While you’re still hesitating about whether to validate an idea, others may have already validated ten ideas and found the useful one.

That’s all for today’s sharing. Welcome to the FMZ platform to try and experience more.

Appendix: Complete Source Code and Resources

Complete Source Code

FMZ Quantitative Platform:

You can substitute different AI models and select validation cryptocurrencies.

Risk Warning

- This article is for technical learning only and does not constitute investment advice.

- Cryptocurrency trading carries extremely high risks and may result in total loss of principal.

- Be sure to conduct thorough testing before using real funds.